Job creation exceeded expectations in February, but the unemployment rate rose and job growth in the first two months was not as strong as initially reported.

Non-farm employment increased by 275,000 this month, and the unemployment rate rose to 3.9%. Department of Labor Bureau of Labor Statistics reported on Friday. Economists surveyed by Dow Jones had expected employment to increase by 198,000.

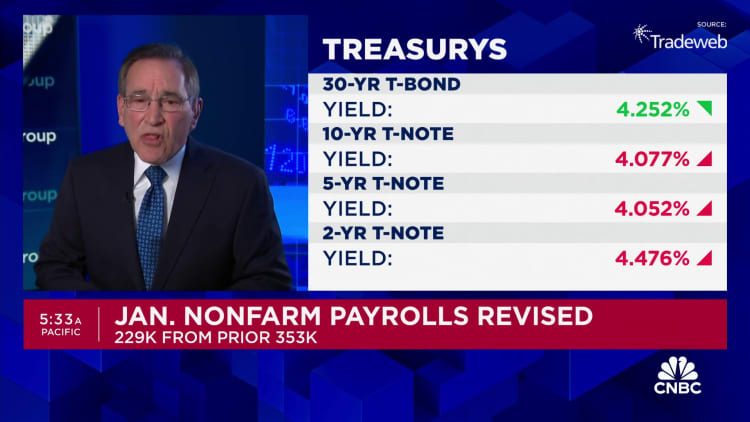

February’s increase was a step higher than January’s increase, which was revised sharply down to 229,000 from an initially reported increase of 353,000. December job growth was also revised down to 290,000 from 333,000, bringing the two-month total to 167,000 fewer jobs than initially reported.

Unemployment rate increases with household surveyThe data used to calculate the unemployment rate showed that employment fell by 184,000. Although the labor force participation rate remained stable at 62.5%, the “prime age” rate rose to 83.5%, an increase of two-tenths of a percentage point. The agency survey shows total employment.

Average hourly earnings, closely watched as a gauge of inflation, showed growth this month was slightly less than expected and slower than a year earlier. Wages rose just 0.1% this month, one-tenth of a percentage point lower than expected, and were up 4.3% annually, down from January’s 4.5% increase and slightly below expectations of 4.4%.

Working hours have rebounded from the decline in January, with the average weekly working hours reaching 34.3 hours, an increase of 0.1 percentage points.

The jobs data could lead to a rate cut by the Federal Reserve later this year, although the timing and magnitude remain uncertain.

Stocks rose on Friday following the news, with the Dow Jones Industrial Average up nearly 150 points in early trading.Treasury yields lower; benchmarks 10 year note The latest report was 4.07%, down about 0.02 percentage points from that day.

“It really provides a data point for a variety of views,” Liz Ann Sonders, chief investment strategist at Charles Schwab, said of the report. Those ranged from “economic Going into recession to Goldilocks, everything is fine, there’s not much to see here. It’s definitely a mixed bag,” she added.

Job creation is skewed toward part-time positions. According to the household survey, full-time jobs fell by 187,000, while part-time jobs increased by 51,000. Another measure of unemployment, sometimes called the “real” unemployment rate, which includes discouraged workers and people working part-time for economic reasons, edged up to 7.3%.

From an industry perspective, healthcare led the way, adding 67,000 new jobs. The government was again a significant contributor, providing 52,000 people, with restaurants and bars adding 42,000 and social assistance adding 24,000. Other industries with gains included construction (23,000), transportation and warehousing (20,000) and retail (19,000).

The report comes as markets are nervous about the health of the overall economy and its possible impact on monetary policy.Futures trading move slightly Following the report, traders now see a greater likelihood of the Fed cutting interest rates for the first time in June.

“There’s nothing new between this report and last month’s report. It doesn’t really give us a ton of information other than that we can say qualitatively that we’re still growing jobs at a good rate and wages are still growing. “This number is a little higher than we would like,” said Dan North, senior economist at United Trading Americas. “

North added that the report likely “doesn’t change the narrative” from the Fed, although he believes the first rate cut likely won’t happen until July.

In recent days, Fed officials have sent mixed signals that inflation is cooling but not enough to warrant a rate cut for the first time since the early days of the coronavirus pandemic crisis.

Speaking on Capitol Hill this week, Fed Chairman Jerome Powell said the labor market is “relatively tight” but is now in a better balance than in the days when job openings outnumbered available workers at a 2-to-1 ratio. .

At the same time, he said inflation “has slowed significantly” but still has not shown enough progress to return to the Fed’s 2% target. But he told the Senate Banking Committee on Thursday that economic conditions put the Fed “not far away” from starting to ease monetary policy.

“We have a data-dependent Fed, which means we are all at the mercy of the data,” Sanders said. “Significant moves outside the consensus range of labor market data and inflation data can provide a boost. But if the numbers are consistent or mixed, then we jump straight to the next report.”

Despite a series of high-profile layoffs, particularly in the technology industry, job creation remains strong. Recently, companies such as Cisco, Microsoft and SAP have announced significant layoffs. Employment consultancy Challenger, Gray & Christmas said it was the worst February for job cuts announcements since the tail end of the global financial crisis in 2009.

However, workers still appear to be able to find work. Job openings were little changed in January at nearly 9 million, but still outnumbered the number of unemployed people by a ratio of 1.4 to 1. Weekly jobless claims were little changed, with 217,000 in the most recent week, but continuing claims were just over 1.9 million, while the four-week moving average of the indicator reached its highest level since December 2021 .

Amid conflicting signals, markets have lowered expectations for a rate cut from the Federal Reserve. Futures market traders expect the first rate cut in June this year, compared with March expectations at the beginning of the year, and now expect a total of four rate cuts this year, compared with six to seven previously, according to CME Group data.