On July 17, 2016, people were using mobile phones in Suragada, Indonesia.

Solo Now | Barcroft Media | Getty Images

Smartphone shipments in Southeast Asia continued to recover in early 2024, contrasting with downturns in other regions, as a promising market for mobile manufacturers continues to attract more brands and investment.

According to statistics, smartphone shipments in the top five markets in the region were 7.26 million units, a significant increase of 20% compared with the same period last year. Research A report released on Wednesday by technology market analysis firm Canalys.

The results extend a market rebound that began in the fourth quarter of 2023, when mobile phone shipments in Southeast Asia increased year-on-year for the first quarter in nearly two years, accompanying the broader industry recovery after the pandemic.

Canalys analyst Le Xu said inflationary pressures stabilized and consumer confidence and spending rebounded, driven by government support and sales activity in the region at the end of 2023.

“To take advantage of market recovery, smartphone manufacturers that adopted conservative strategies over the past six months are now adopting aggressive strategies to gain market dominance,” he said in a press release, pointing to affordable 5G. , artificial intelligence integration, ecosystem development and other trends. , and channel optimization.

In January, Samsung regained the top market share in the region with the successful launch of its premium S24 series, which offered longer battery life and new artificial intelligence features.

However, Chinese competitors pay more attention to the market, capture the market and offer new mobile phone models at competitive prices. Xiaomi was the region’s second-largest mobile phone brand in January shipments, up 128% year-on-year, while Transsion, a relative newcomer to the market, grew 190%.

“Rising disposable income from the region’s expanding middle class and young population entering the workforce is a strong reason to anticipate increased investment,” Cheiw said.

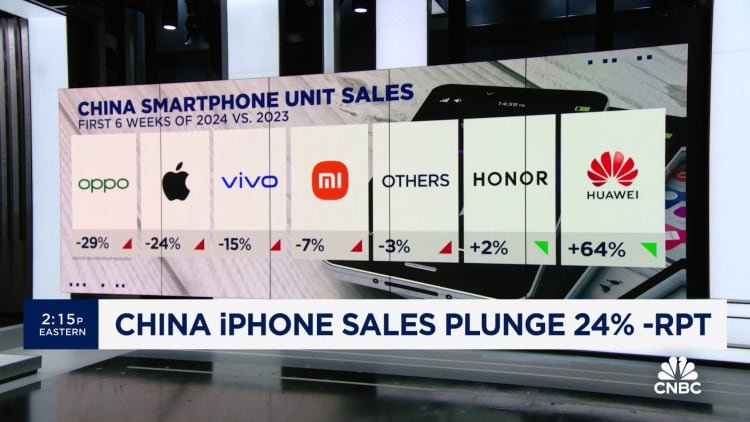

Strong smartphone shipments in Southeast Asia are in sharp contrast to China, the world’s largest smartphone market. According to statistics, Chinese smartphone sales fell 7% year-on-year in the first six weeks of 2024. Tuesday report From counterpoint studies.

Senior analyst Ivan Lam said in a report that while unusually high sales in early 2023 exacerbated the decline in sales in China, other factors contributed to the market downturn.

“Consumer confidence needs to rise to stabilize the market, but with everything that’s going on right now, especially in the housing industry, it’s a tough call,” he said.

Research shows Apple is a victim, with its smartphone shipments in China falling 24% in the first six weeks of this year. This decline is partly due to the resurgence of local rival Huawei, but also due to early production delays that led to unusually high Apple shipments in early 2023.

However, as smartphone markets such as China and the United States slow down, brands selling high-end phones such as Apple and Huawei are increasingly looking to emerging markets such as Southeast Asia that are expected to grow.

According to data from Canalys, the Southeast Asian mobile phone market is expected to grow by 7% annually in 2024, much higher than the 3% growth rate in other regions of the world. Meanwhile, China is expected to grow by 1%, while the North American market is expected to be flat.

According to reports, from Bloomberg, Apple’s first retail store in Malaysia is already under construction.At the same time, Huawei has been keep in good touch Working with Southeast Asian partners such as Indonesian telecommunications company Telkomsel.

A Canalys report shows that Indonesia remains the largest smartphone market in Southeast Asia, accounting for 38% of January shipments. The Philippines, the second largest market, had the strongest growth, with shipments in January rising 77% compared with the same period last year.

The second largest markets are Thailand, Vietnam and Malaysia, in order. Vietnam was the only country to see a year-on-year decrease in shipments, down 2%.