Goran Babik | Electronic+ | Getty Images

Building a $1 million reserve may seem like an impossible task.

However, financial advisors say just about anyone can build such retirement wealth if they take certain steps.

“You might be thinking, ‘Well, I have to be a Silicon Valley entrepreneur to get rich,'” says Brad Klontz, a financial psychologist and certified financial planner.

Klontz, a member of CNBC’s Financial Advisory Board and CNBC’s Global Financial Wellness Advisory Board, says you can, in fact, be a fast food worker your entire life and build wealth.

The calculation is simple, he said.

Klontz says that every time you get paid a dollar, save and invest a certain percentage toward your “financial freedom.”

With this mindset, “you can work almost any job and retire as a millionaire,” he said.

It doesn’t have to be a “tough task”

Saving $1 million may sound like a “tall task,” but it’s “probably not as hard as you think,” says Karen Wallace, CFP and former director of investor education at Morningstar. Wrote 2021.

Experts say the key is to start saving early, perhaps in a 401(k) plan, an individual retirement account or a taxable brokerage account. This allows investors to harness the magic of compound interest over decades. In other words, you “let your investments do as much of the heavy lifting as possible,” Wallace writes.

About 79% of U.S. millionaires say they “made their net worth from scratch,” according to Northwestern Mutual polling Published in September. According to a survey of 4,588 U.S. adults conducted from January 3 to 17, 2024, only 11% said they inherited their wealth, while 6% obtained it through a windfall such as winning a lottery.

More from Personal Finance:

IRS: Critical deadline for RMDs looming

Egg prices may soon ‘hit all-time highs’

The Fed may cut interest rates next week

As of September 30, 544,000 Americans had a 401(k) balance of more than $1 million. according to Fidelity Investments is the largest administrator of workplace retirement plans. The number of IRA millionaires also exceeds 418,000.

In fact, the number of 401(k) millionaires increased by 9.5%, or 47,000, between the second and third quarters of 2024, largely due to rising stock markets.

How to reach $1 million

Vera Rode Savant | Moment | Getty Images

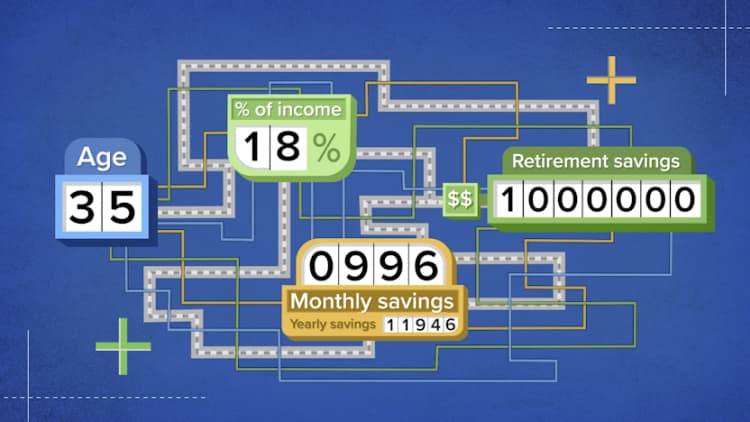

Financial advisor Winnie Sun provides a mathematical example linking $1 million in wealth to consistent savings.

Suppose a 30-year-old earns $60,000 per year after taxes. Assuming an average market return of 7%, she said, if they saved $500 a month, or 10% of their annual income, they would have $1 million by age 70.

That doesn’t take into account financial factors that could increase savings during this period, such as company 401(k) matches, bonuses or salary increases.

You can work almost any job and retire as a millionaire.

Brad Kranz

Financial Psychologist and Certified Financial Planner

“In 40 years, you will have more than $1 million, and that’s just $500 a month,” said Sun, co-founder of Sun Group Wealth Partners in Irvine, Calif., and a member of CNBC’s financial advisory board.

It’s also important to avoid debt, which can be the “biggest hole” in accumulating savings, and try not to add too much spending, Sun explained.

Timing is more important than perfection, Sun said.

She recommends starting with a low-cost index fund — such as one that tracks the S&P 500, which diversifies savings from the largest U.S. public companies — and building from there.

“Even waiting a year can have a huge impact on reaching the $1 million goal,” Sun said. “Stop and take action.”

What is the appropriate amount of savings?

Damir Kudik | Electronic+ | Getty Images

Of course, a $1 million retirement nest egg may not be suitable for everyone.

An often-cited rule of thumb—called 4% Rule – Says the typical retiree can withdraw about $40,000 per year from a $1 million nest egg to safely assume they won’t run out of money in retirement. (Withdrawals are adjusted for inflation each year.)

For many, that money will be supplemented by Social Security.

Fidelity recommends setting savings goals based on income. For example, by age 67, workers should designed to save 10 times your annual salary to ensure a comfortable retirement life.

Ideally, families aim to save 15% to 20% of their income, Sun said. This is a rule of thumb often cited by financial planners.

How much wealth you want — and how quickly you want to get rich — will determine that percentage, Klontz said.

His personal goal is a 30% savings rate, but he knows people with savings rates closer to 90%. Saving such a large portion of income is a common thread in the so-called “FIRE” movement, which stands for “Financial Independence, Retire Early.”

How did they do it?

“They didn’t move out of their parents’ house, they minimized everything, they didn’t buy new clothes, they took the bus, they shaved their heads instead of paying for haircuts,” Klontz said. “If you want to get there faster, there are all kinds of tricks you can do.”

How to enjoy today and save for tomorrow

Of course, there are tensions here for those who want to enjoy life today and save for tomorrow.

“Our purpose is not just to survive and save money,” Sun said. “There has to be a good quality of life and a happy medium.”

One strategy, Sun says, is to allocate 20 percent of your household expenses to the things that matter most to you — maybe a big vacation, a luxury car or the latest technology.

She said making some concessions on the other 80% of household expenses means “being budget-conscious.” This helps savers feel their quality of life has not been reduced, she said.