On January 4, 2024, a Tesla car drove past a store of the electric vehicle (EV) manufacturer in Beijing, China.

Florence | Reuters

This is the brutal first season Tesla investor.

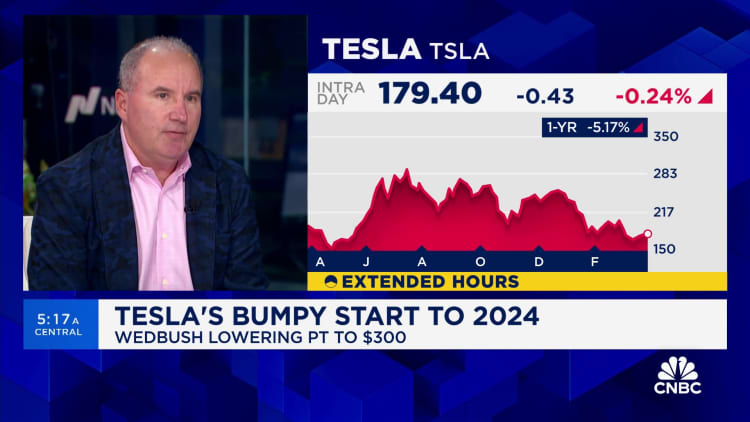

The electric car maker’s shares plunged 29% in the first three months of this year, the stock’s worst quarter since late 2022 and its third-largest decline since Tesla went public in 2010. It was also the biggest loser in the S&P 500.

Wall Street’s biggest concern is Tesla’s core business. The company is preparing to report first-quarter vehicle production and deliveries in the coming days, and even bulls expect weak results despite pending price cuts and incentives for buyers throughout the quarter.

As of Thursday, the final trading day of the quarter, analysts expected deliveries of about 457,000 aircraft in the quarter, according to the average forecast of 11 analysts compiled by FactSet. That would be an 8% increase from 422,875 a year ago. Deliveries for the quarter are expected to be 414,000 to 511,000 units.

Analysts updating data in March were the most pessimistic, with forecasts ranging from 414,000 to 469,000. Independent auto industry researcher Troy Teslike expects the company’s deliveries to be below FactSet’s lowest estimate.

Deliveries are the closest thing Tesla reports to sales, but it’s not clearly defined in the company’s shareholder communications.

Here are four main reasons for Tesla’s first-quarter performance decline.

China is ruthlessly competitive

Competition for all-electric vehicles is growing in China, including new models that cost less than Tesla’s popular Model Y SUV and Model 3 sedan.

Chinese smartphone company Xiaomi is launching its first car, an all-electric SUV that costs far less than Tesla’s entry-level Model 3 sedan. Xiaomi CEO Lei Jun said the standard version of the SU7 will sell for $30,408 in China, a price he acknowledged meant the company would lose money on every sale.Tesla Model 3 approx. Pay $4,000 more Compared to that.

Tesla cut prices in response, but sales are still sluggish.

According to data from the China Passenger Car Association, Tesla’s domestic vehicle sales in January were 71,447 units, of which domestic sales were 39,881 units, a decrease from December. In February, the number of Teslas built in China fell again to 60,365, including exports.

Bloomberg reported that as sales fell, Tesla reduced output at its Shanghai factory and moved employees to a five-day workweek from a six-and-a-half-day schedule. first reported.

Tesla did not provide guidance for 2024 during its January earnings call, but analysts believe Tesla’s difficulties in China are a harbinger of a difficult quarter, if not the full year.

Deutsche Bank analyst Emmanuel Rosner cut his price target on Tesla this week, citing weaker-than-expected sales in China and the company’s recent plans to cut production in the region. Rosner currently expects Tesla to deliver 414,000 vehicles in the first three months of 2024, and expects Tesla’s sales to achieve mid-single-digit growth this year.

Red Sea attack, militant clashes in Europe

There was drama in Europe too.

Other manufacturers such as Tesla and Volvo suspended some production on the continent in January due to parts shortages after attacks on Red Sea shippers. Attacks by Iran-backed Houthi militias continue to disrupt one of the world’s busiest routes.

On March 13, 2024, Tesla CEO Musk arrived at the Tesla factory in Grünheide, Germany.

Christian Bossi | Bloomberg | Getty Images

Then in March, German environmentalists staged a dramatic protest. Protesters opposed Tesla’s plans to expand its car and battery factory in Brandenburg, outside Berlin, and set fire to electrical infrastructure near the Tesla plant. Although the fire did not spread to the factory, the plant did not have enough power to operate, forcing production to temporarily halt.

After the attack, Chief Executive Elon Musk visited the German factory to reassure employees. He also called the protests “extremely stupid.” Tesla’s head of policy, Rohan Patel, wrote on factories and a culture of doing the right thing in our communities.”

Meanwhile, in the Nordic country, Tesla service technicians and other workers have been on strike in support of Swedish trade union IF Metall. The labor group has been pressuring Tesla since October 2023 to negotiate with its workers and sign a collective bargaining agreement.

IF Metall’s website says nine out of 10 workers in Sweden are members of a union, but Tesla has boycotted unions, as it has always done in the United States, and rejected IF Metall’s negotiating efforts.

The lineup is aging and Cybertruck is still in its early stages

While electric vehicle sales remain increasingly popular around the world, growth has slowed. As Tesla no longer dominates, each new product becomes more important. There isn’t much in the hopper.

The Cybertruck is still in its early stages and has a niche audience. The company began delivering angular, unpainted steel truck models at a promotional event in Austin, Texas, in December.

Musk previously said on an earnings call that Tesla was “digging its own grave” with the sci-fi-inspired Cybertruck. In a late 2023 interview with Tesla fan and car critic Sandy Munro, Musk warned that “Cybertruck will not have a significant impact on Tesla’s financial situation in 2024,” And “there may be a significant impact in 2025.”

On November 28, 2023, a Tesla Cybertruck inside a Tesla store in San Jose, California.

Bloomberg | Bloomberg | Getty Images

Tesla has been ramping up production of its updated Model 3, called Highland, in Fremont, California. “Visually, the exterior changes are subtle,” Forbes’ Larry Magid wrote. He also didn’t like Tesla’s controversial design decision to omit “stems” on either side of the steering wheel. Highland drivers use button and screen controls to switch between driving, reversing and parking, or to signal a turn or lane change.

Tesla is indeed developing a new platform, a more affordable electric car that fans are calling the “Model 2.” But it won’t be delivered to customers for several years.

Musk’s Control and Controversy

Musk continues to bet that Tesla customers and shareholders will continue to support the company, despite his increasingly inflammatory rhetoric on X and elsewhere.

Earlier this month, Musk met with former President Donald Trump in Florida. He was asked to “red wave“Ahead of the upcoming U.S. election, he shared, liked, or otherwise promoted far-right accounts and content on X, where he currently has 178.8 million followers. He has repeatedly disparaged undocumented immigrants and vehemently opposed corporations Diversity initiatives and making ridiculous claims: Immigrants from Haiti are cannibals.

Musk’s political ideology is at odds with the people most likely to buy his products.Supporters of electric vehicles lean left ideologically, according to study pew research center and Gallup last year.

Musk is also betting that Tesla shareholders and its board of directors will follow his lead. In February, Musk said a judge in Delaware found the board failed to prove “that the compensation plan is fair.”

Ahead of the ruling, Musk had begun pressuring shareholders and Tesla’s board to give the electric car maker more control.

“I am uncomfortable with Tesla becoming the leader in artificial intelligence and robotics without having ~25% voting control,” Musk wrote in a January post.

Longtime Tesla investor Ross Gerber called the demand tantamount to “extortion.” Interviewed by CNBC.

bear cleaning up

All of this has cost Tesla and its shareholders more than $230 billion in market value since the calendar turned into 2024. This has been a very profitable quarter for short sellers, who had been anticipating such a downturn.

According to data from S3 Partners, Tesla short positions increased by more than $5.77 billion in 2024, making it the most profitable company in the United States. At the end of trading on Thursday, short positions accounted for approximately 3.76% of the float, with a notional value of $18.71 billion.

Brad Gerstner of Altimeter Capital is Buy the dip. Gerstner told CNBC this week that the company is currently making “tremendous progress at an accelerated pace” in its self-driving technology.

Musk has been making statements like this for years. In 2015, he told shareholders that Tesla’s cars would be “fully autonomous” and capable of driving themselves by 2018. In 2016, he said Tesla would be able to drive one of its cars off-road by the end of the following year without any human intervention.

Tesla has yet to introduce robo-taxi, self-driving cars or the technology that would make its cars “Level 3” self-driving. However, Tesla offers advanced driver assistance systems (ADAS), including a standard Autopilot option, or an advanced fully autonomous driving “FSD” option, the latter of which costs US subscribers $199 per month, or $12,000 up front.

To boost end-of-quarter sales, Musk recently asked all sales and service staff to install and demonstrate FSDs for customers before delivering cars. “Few people are really aware of how effective (supervised) FSD actually is. I know it will slow down the delivery process, but it is still a hard requirement,” he wrote in an email to staff.

Despite its name, Tesla’s Advanced option requires a human driver behind the wheel, ready to steer or brake at a moment’s notice.

watch: Tesla is experiencing a ‘code red situation’