Steven Englander, Standard Chartered’s global head of G10 FX research and North American macro strategy, told CNBC that Japan is “very, very close” to intervening in the yen as it falls to multi-decade lows.

“I think we’re actually very, very close to them (Japanese authorities) stepping in… They’ve discussed the political consequences, no one is sitting there asking for a devaluation of the yen,” Englander told CNBC’s “Squawk Box Asia.” “Thursday.

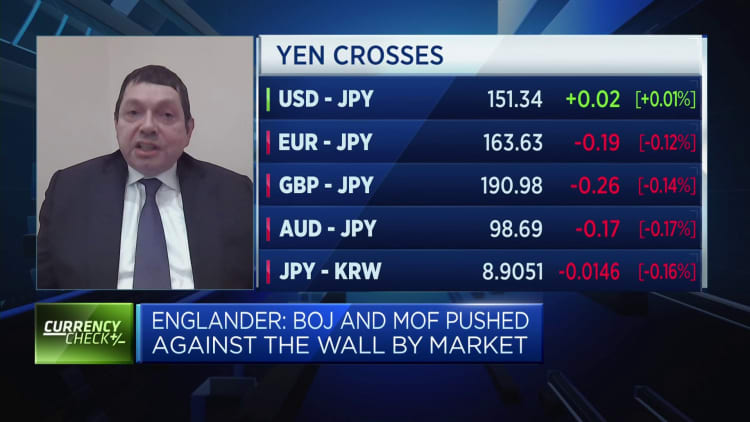

this yen It was trading around 151.47 against the U.S. dollar on Thursday, after falling to a 34-year low of 151.97 the previous day.

These multi-decade lows have fueled speculation about potential intervention in the currency.

Japanese Finance Minister Shuni Suzuki said this week that measures “to deal with disorderly currency fluctuations” were not impossible.Masato Kanda, Deputy Minister for International Affairs, Ministry of Finance of Japan It is reported that On Wednesday, the yen’s movement came under close and urgent scrutiny.

Japan’s Chief Cabinet Secretary Yoshimasa Hayashi said on Thursday that authorities Not excluded According to Reuters, any measures to counter excessive currency fluctuations echo other government members who are watching currency fluctuations with a high degree of urgency.

Standard Chartered’s Englander said the potential intervention in the yen was aimed at buying the Japanese authorities time until the Fed starts cutting interest rates or the Bank of Japan raises them further.

He further noted that the last time Japanese authorities intervened in the yen in 2022, “it worked quite well,” although investors were initially skeptical about the effectiveness of such currency intervention.

The Bank of Japan’s historic end to negative interest rates last week and the removal of its yield curve control policy did little to stem a weakening yen.

On the other hand, the Federal Reserve kept its benchmark interest rate stable last Wednesday as expected and signaled that it planned to cut interest rates multiple times before the end of the year.