UBS Chief Executive Sergio Ermotti said on Friday the failed massive integration of Credit Suisse and its former rival UBS will be a “case study” that will show how big bank mergers should be allowed .

“This will be a case study that needs to be evaluated globally, especially in Europe, and in my opinion ultimately there is a need to create stronger banks and banks that are stronger and more competitive from a global perspective ,” Ermotti told CNBC’s Steve Sedgwick at an event at the Ambrosetti Spring Forum in Italy.

“Of course, we cannot rely solely on crises to create or promote bank mergers,” Ermotti said.

“It’s good to have strong players that can be part of the solution, like UBS in the Credit Suisse case… but it can’t be just that part. So in that sense, I think really The problem is that there must be “a political desire to promote something like this. So that’s not the reality today,” he added.

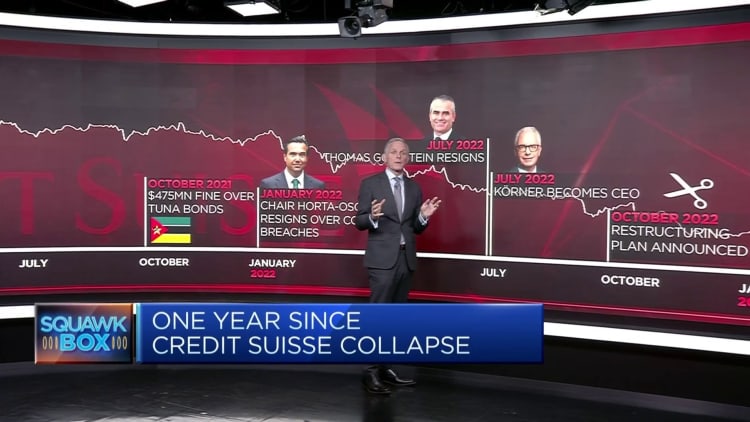

Credit Suisse collapsed in March 2023 after years of poor performance, scandals and risk management crises. UBS completed its acquisition of the 167-year-old bank in June in a controversial deal brokered by Swiss authorities.

The Swiss National Bank said the size of the new entity signals potential competition issues that need to be monitored.

“I think the good news is that in many countries there is recognition that they want to protect their banks or financial institutions as national champions, either as an implicit or explicit recognition of their economic value,” Ermotti said on Friday. .

“But the bad news is that they don’t realize that in order to really play a role and contribute further to the economy, they also need to be more competitive on a global scale. But without a banking union, there is no banking union. Capital Markets Union, it will be very, very difficult for Europe to compete with the big US banks.”

Unlike the United States, European economies continue to rely on the banking sector for corporate financing; Ermotti said Europe has a “completely different competitive environment and lacks key capabilities.”

“So I hope, I don’t quite believe it will happen anytime soon, but I hope that eventually one day these types of mergers between the big banks will be allowed and we can contribute to that by showing that it’s possible. At the same time “I think in many countries critical mass and synergies can be created through further local mergers,” he said.