Oil giant Shell reportedly considering ditching London for New York

A sign at a petrol station in Kuru, Kenya displays the Shell logo.

Sopa Images | Light Rocket | Getty Images

British oil giant shell The company is considering ditching the London Stock Exchange and listing in New York instead, according to a report in The Daily Telegraph report on Monday.

Chief Executive Wael Sawan said the company was looking at “all options” amid concerns it did not receive enough support from investors.

“My position is obviously undervalued,” he said.

The exit of the FTSE 100’s largest company would be a major blow to British stocks, which have struggled to maintain their leading position amid weak economic growth and market uncertainty caused by Brexit.

A Shell spokesperson told CNBC that the comments follow plans outlined at the company’s Capital Markets Day in June 2023 to close the so-called “valuation gap.”

The spokesperson added: “After 2025, if valuations do not reach where we believe they should be, then as Wael has stated publicly on multiple occasions, we will explore other options.”

— Karen Gilchrist

U.S. stocks open higher

U.S. stocks opened higher on Monday as Wall Street tried to rebuild momentum after pulling back last week.

The Dow Jones Industrial Average opened up 0.11%, while the S&P 500 was flat. The Nasdaq rose 0.13% in early trading.

— Karen Gilchrist

German industrial production shows ‘end of stagnation’

Carsten Brzeski, ING’s global head of macro, said in a note that better-than-expected German industrial production data on Monday signaled “the end of first-quarter stagnation.”

Industrial production rose 2.1% quarterly in February, much higher than the 0.3% increase expected by analysts polled by Reuters.

“While German industrial sentiment indicators have been at low levels since late last summer, this morning’s industrial data already indicate that the stagnation in the first quarter is over,” Brzeski said.

He said expected interest rate cuts from the European Central Bank, falling energy prices and a stronger U.S. economy would benefit German industry.

However, he stressed that this was not the start of a “significant recovery” given recent weakness in industrial orders and inventory drawdowns.

—Jenny Reed

Gold looks ‘very vulnerable to setbacks’, says senior adviser

Gold prices extended their record-breaking gains on Monday, hitting another all-time high on the back of strong U.S. economic data and rising geopolitical tensions.

Spot gold prices were up 0.5% at $2,342 an ounce at around 11:45 a.m. London time, after briefly touching a new record of $2,353 earlier in the session. The yellow metal has hit record highs several times in recent weeks.

However, Bob Parker, senior adviser at trade body International Capital Markets Association, said gold’s fundamentals painted a bearish outlook going forward. These include a stronger dollar, rising bond yields, doubts about the Federal Reserve’s plans to cut interest rates and “reasonably” low inflation.

“Quite frankly, all of these factors actually point to very little upside for gold, and I think gold is very vulnerable to a setback right now,” Parker said.

Read the full story here.

— Sam Meredith

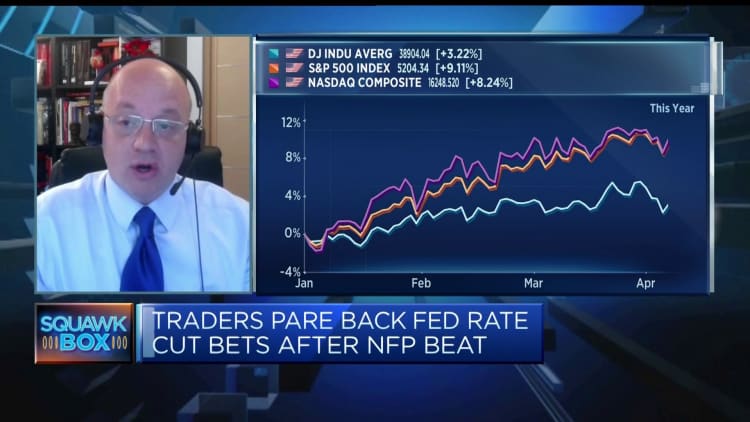

Economists increasingly uncertain about Fed rate cuts this year

The Fed is determined not to cut interest rates prematurely, and some economists say recent data has completely ruled out a summer rate cut.

Friday’s jobs report reiterated the seemingly unwavering strength of the U.S. labor market and signaled the need for further caution from the Federal Reserve. All eyes are now on Wednesday’s consumer price index after February’s annual inflation rate of 3.2% came in slightly higher than expected.

George Lagarias, chief economist at Mazars, told CNBC on Monday that a summer rate cut now looks much less likely.

“This is a strong economy. There’s no doubt it’s underpinned by debt and a certain level of credit card burdens, but it’s a strong economy. So it’s going to be hard for the Fed to find a reason to cut rates as quickly as possible,” Lagaria said Si said.

“The Fed has been punishing itself since 2021, when the ‘temporary team’ ostensibly made mistakes…Their sense is that they can’t afford to make mistakes anymore, which means they are more likely to make mistakes. Watch out,” Lagarias added.

Read the full story here.

—Jenny Reed

Atos shares soar 30% after Butler joins rescue consortium

Athos stock price.

Shares in French IT consultancy Atos rose 30% in morning trading major shareholder Onepoint said investor Butler Industries Join the consortium to save the company.

French Prime Minister Gabriel Attal said last week Ensuring financial security is a national priority distressed company. Its projects involve communications for the French army and secret services and supercomputer manufacturing, and will manage cybersecurity for this summer’s Paris Olympics.

—Jenny Reed

Stock Trend: Zalando and Entain rise, BBVA falls

Ladbrokes betting shop operated by Entain Plc on Wednesday, September 22, 2021, in London, England.

Chris J. Ratcliffe | Chris J. Ratcliffe Bloomberg | Getty Images

German retailer stocks Zalando The stock rose 4.75% in early trading after Citi analysts upgraded the stock to “buy” from “neutral.”

The largest increase was seen in gambling companies Include rose 3% after Report The Times suggested private equity firms were interested in some of its assets.

bank BBVA It then fell 3.4% declare A final dividend of 0.39 euros ($0.42) per share will be paid on Wednesday.

—Jenny Reed

European stocks open mixed

European markets start the week cautiously, benchmark indexes Stoke 600 The index was down 0.06% at 8:05 am in London.

France’s CAC 40 index and Britain’s FTSE 100 index were both close to flat lines, while Germany’s DAX index edged up 0.2%.

Stoxx 600 Index.

CNBC Pro: Goldman Sachs just updated its list of the world’s top stocks and recommends specific trading strategies

Despite a lackluster performance last week, pan-European Stoke 600 The index is up about 7.5% year to date and more than 15% in the past 12 months.

However, Goldman Sachs analysts noted that investors are “questioning how much upside is left” and suggested that investors consider specific trading strategies.

They also updated their “Conviction List” of top picks for April.

CNBC Pro subscribers can read more here.

— Amala Balakrishna

Bank of America says this week’s consumer price index should be “a confidence-building report”

Economists at Bank of America believe that Wednesday’s inflation report should show that price pressures have eased, providing confidence for the Federal Reserve to cut interest rates in June.

The Wall Street firm expects core consumer prices to slow to 0.2% in March after rising 0.4% in February and January. It believes falling car prices will lead to declines in core commodities. But at the same time, the bank expects energy prices to rise more than usual.

“The slowdown in core CPI should reflect lower prices for core goods and modest increases in prices for core services,” economists at the bank said in a note. “A report in line with our expectations would provide the Fed with confidence and allow the June rate cut to continue to work.”

— Yun Li

CNBC Pro: ‘Big bargain’: Morgan Stanley names 3 overlooked global tech stocks worth buying

Morgan Stanley has named three “overlooked” global technology stocks and says they currently look cheap.

The bank said the theme of “scaling to scale” will become more important and “investors will increasingly look to high-quality small caps at attractive valuations as a source of alpha.”

All three stocks are Overweight, with one offering nearly 100% upside.

CNBC Pro subscribers can read more here.

— Weizhen Tan

European Markets: Here are the opening calls

European markets are set to open higher on Monday.

According to IG data, the FTSE 100 is expected to open 11 points higher at 7,913 points, Germany’s DAX index rose 29 points to 18,191 points, and France’s CAC 40 index rose 21 points to 8,078 points.

—Jenny Reed

The U.S. added 303,000 jobs in March, exceeding expectations

A Nugget Markets “Now Hiring” sign is posted on the side of a Golden Gate bus in San Rafael, California, on July 7, 2021.

Justin Sullivan | Getty Images

On Friday morning, non-farm payrolls data for March came out stronger than expected, another sign of resilience in the U.S. labor market.

The U.S. economy added 303,000 jobs last month, exceeding the 200,000 expected by economists polled by Dow Jones. The unemployment rate is 3.8%.

Average hourly earnings rose 0.3% in March, up 4.1% from the same period last year. The average working hours per week is 34.4 hours.

— Jesse Pond