Inflation showed few signs of abating in March, with a key barometer closely watched by the Federal Reserve showing price pressures remained high.

The U.S. Commerce Department reported on Friday that the personal consumption expenditures price index excluding food and energy increased 2.8% year-on-year in March, unchanged from February. This was higher than the Dow Jones consensus forecast of 2.7%.

Including food and energy, the PCE price index for all commodities rose 2.7%, compared with expectations of 2.6%.

On a monthly basis, both indicators grew 0.3%, in line with expectations and the same as February’s growth.

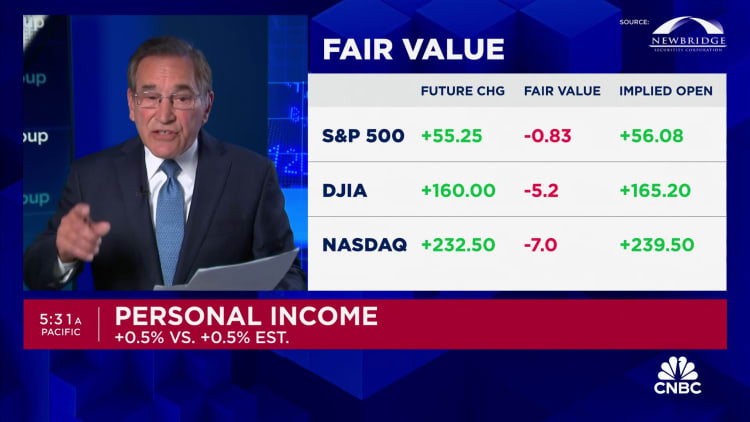

The market reaction to the data was muted, with Wall Street expected to open higher. U.S. Treasury yields fell, with the benchmark 10-year Treasury yield at 4.67%, down about 0.4 percentage points from the day. Futures traders were slightly more optimistic about the likelihood of two potential rate cuts this year, raising the likelihood to 44%, according to CME Group’s FedWatch indicator.

“The inflation report released this morning is not as hot as people feared, but investors should not be overly confident that inflation has been fully alleviated and that the Fed will provide support in the near term,” said Fed Chairman George Mateyo. Cut interest rates.” Chief Investment Officer of Ki Wealth. “The prospect of a rate cut remains, but not certain, and the Fed may need a weakening labor market to feel confident in cutting rates.”

Consumers say they are still spending despite rising price levels. Personal spending rose 0.8% this month, slightly above expectations of 0.7% but unchanged from February. Personal income increased by 0.5%, in line with expectations and higher than the 0.3% increase in the previous month.

As households dipped into savings to maintain spending, the personal savings rate fell to 3.2%, down 0.4 percentage points from February and down 2 percentage points from the same period last year.

The report follows bad inflation news on Thursday, with the Fed likely to keep interest rates on hold at least through the summer unless there is a significant change in the data. The U.S. Department of Commerce reported on Thursday that PCE annualized growth was 3.4% in the first quarter, while gross domestic product (GDP) grew only 1.6%, far below Wall Street expectations.

With inflation still spreading two years after it first rose to its highest level in more than 40 years, central bank policymakers are watching the data more closely as they consider the next steps for monetary policy.

The Fed’s inflation target is 2%, and core PCE has been above this level for the past three years.

The Fed focuses specifically on personal consumption expenditures because it adjusts to changes in consumer behavior and puts less weight on housing costs than the Labor Department’s more widely circulated consumer price index.

Although Fed officials focus on both overall and core indicators, they believe that data excluding food and energy indicators can better understand long-term trends, because these two types of indicators tend to be more volatile.

Prices for services rose 0.4% for the month and prices for goods rose 0.1%, reflecting a pickup in consumer prices as goods inflation has dominated since the early days of the pandemic. Food prices actually fell 0.1% this month, while energy prices rose 1.2%.

On a 12-month basis, services prices rose 4%, while goods prices were little changed, rising just 0.1%. Food rose 1.5% and energy rose 2.6%.

This is breaking news. Please check back for updates.