A job seeker picks up a flyer at a job fair at Brunswick Community College in Bolivia, North Carolina, U.S., Thursday, April 11, 2024.

Alison Joyce | Bloomberg | Getty Images

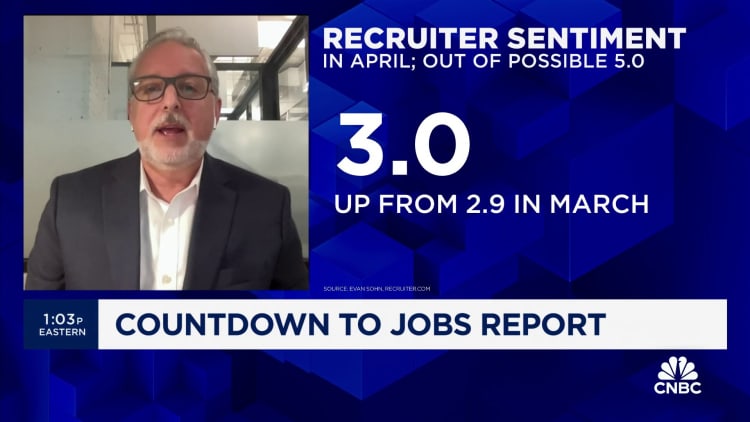

Hiring is likely to continue apace in April as investors look for any cracks in the labor market that could affect the Fed.

According to the Dow Jones consensus, non-farm payrolls are expected to increase by 240,000 this month, with the unemployment rate also holding steady at 3.8%.

If this top-line number is accurate, it would actually reflect a small step down from an average of 276,000 job creation per month so far in 2024. Lower interest rates.

“There are definitely tailwinds,” said Amy Glaser, senior vice president of business operations at talent recruitment site Adecco. “In April, the name of the game is stability — Eddie, because resiliency continues and then We’re looking forward to some seasonal trends heading into summer.”

Glaser added that April’s job market was stronger in health care, leisure and hospitality.These are the two main areas for job growth this year, with health supplement Approximately 240,000 jobs to date Leisure and Hospitality Contribution 89,000.

However, growth in the coming months is likely to spread to areas such as education, manufacturing and warehousing, part of a typically seasonal trend as educators seek alternative employment over the summer and students head out to find work.

“Based on what I’ve seen on the ground, I don’t expect major surprises this month,” Glaser said. “But we’ve been surprised before.”

beyond expectation

In fact, the labor market has been full of surprises this year, beating Wall Street expectations at a time when many economists expected hiring to slow.this An additional 303,000 people were added in March, beating expectations. A large number of data show that the labor economy remains strong, wages continue to rise, and inflation has not changed much after falling sharply in 2023.

That puts the Fed in a difficult position, as officials are reluctant to begin cutting interest rates until they have more convincing evidence that inflation is under control.

Policymakers will be watching some elements of tomorrow’s report for evidence that job growth is not helping to exacerbate price pressures.

Drew Matus, chief market strategist at MetLife Investment Management, said it would be an ideal situation for the Fed if job growth was slightly lower than expected and wage pressures eased while more people entered the labor force. .

“The Goldilocks situation is that the unemployment rate goes up, the participation rate goes up,” Matus said. “This points to a bit of weakness, which should translate into less wage pressures and remove some concerns about persistently high inflation levels.”

Investors are waiting to see

Markets will also keep a close eye on wage data.

The market generally predicts that the average hourly wage growth rate this month is 0.3%, close to the increase in March, and the annual growth rate is 4%, slightly lower than the 4.1% rate in the previous month. However, Matus said immigration patterns and California’s minimum wage increase to $16 an hour this year could skew the wage numbers.

“Inflation has slowed significantly over the past year and the labor market remains strong, which is very good news,” he told a news conference after the central bank’s latest meeting. “But inflation is still too high.”

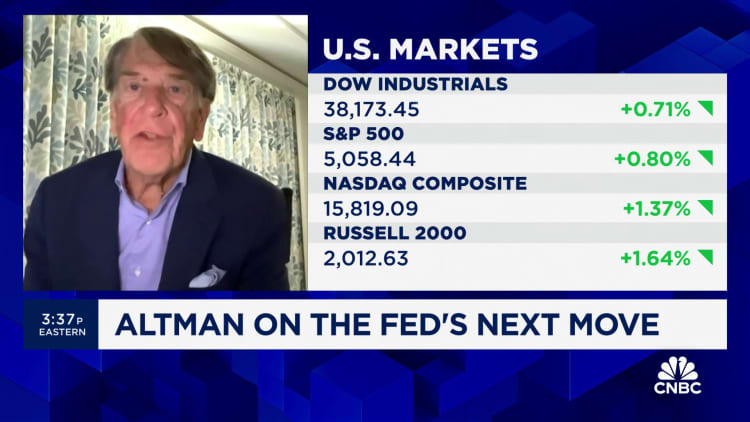

Markets have been on edge as uncertainty over the Fed’s interest rate path grows, although Wall Street was in rebound mode on Thursday, a day before the Bureau of Labor Statistics reported a decline at 8:30 a.m. ET.

“What you’re seeing in the market reflects uncertainty about the path forward. Which is more important to the Fed, unemployment or inflation?” Matus said. “If unemployment started to rise, would the Fed be as concerned about inflation as it is today? And vice versa? And I don’t think we would know that even if the Fed gave us all the information. I don’t know that I Like anybody knows, I think that’s why you see the market behaving the way it does.