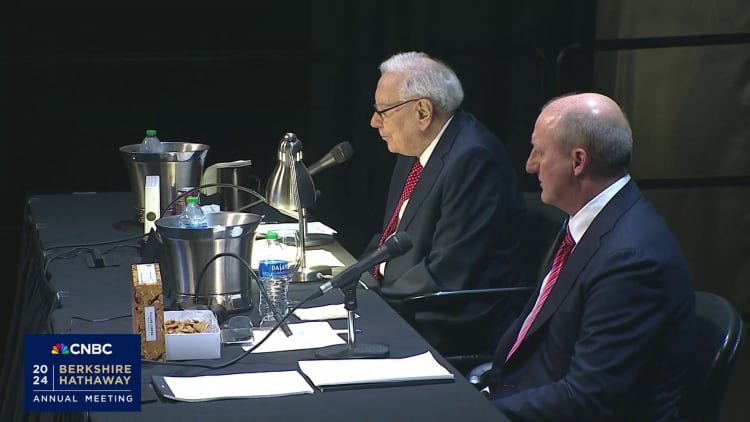

OMAHA, Neb. — Warren Buffett said Saturday that his designated successor, Greg Abel, will be responsible for Berkshire Hathaway’s plans when the “Oracle of Omaha” is no longer at the helm. The company’s investment decisions have the final say.

“I would leave capital allocation to Greg, who knows the business very well,” Buffett told a packed room of shareholders at Berkshire’s annual meeting.

Abel, 61, was named Buffett’s heir apparent in 2021 after Charlie Munger inadvertently revealed the news at a shareholder meeting. Abel has been responsible for managing much of Berkshire’s vast empire, including energy, railroads and retail.

After years of speculation about the precise roles of Berkshire’s top brass after an eventual transition, Buffett provided the clearest insight yet into his succession plans. The investing icon, who turns 94 in August, said his decision was influenced by the size of Berkshire’s assets.

“I had different ideas about how to handle this, but I think the responsibility should lie with the CEO,” Buffett said of future capital allocation in Berkshire’s absence. “Any decision the CEO makes could have consequences. help.

Although Buffett has made it clear that Abel will take over as CEO, questions remain about who will control Berkshire’s public stock portfolio. apple.

Berkshire investment managers Todd Combs and Ted Weschler are both former hedge fund managers who have helped Buffett manage a small portion of his stock investments over the past decade or so. combination (about 10%). There has been speculation that they could take over some of Berkshire’s roles as CEO when he is no longer available.

But judging from Buffett’s latest remarks, Abel will have the final say on all capital allocations, including stock selection.

“I think a CEO should be able to weigh in on acquiring businesses, buying stocks, doing all sorts of things that might arise when other people are not willing to take action,” Buffett said.

Abel is known for his deep expertise in the energy industry. Berkshire Hathaway acquired MidAmerican Energy in 1999, and Abel became the company’s CEO in 2008. Six years later, the company was renamed Berkshire Hathaway Energy in 2014.

This is breaking news. Please check back for updates.