Billionaire investor Stanley Druckenmiller said Tuesday that the Federal Reserve’s reckless government spending is hurting ordinary Americans and jeopardizing President Joe Biden’s re-election chances.

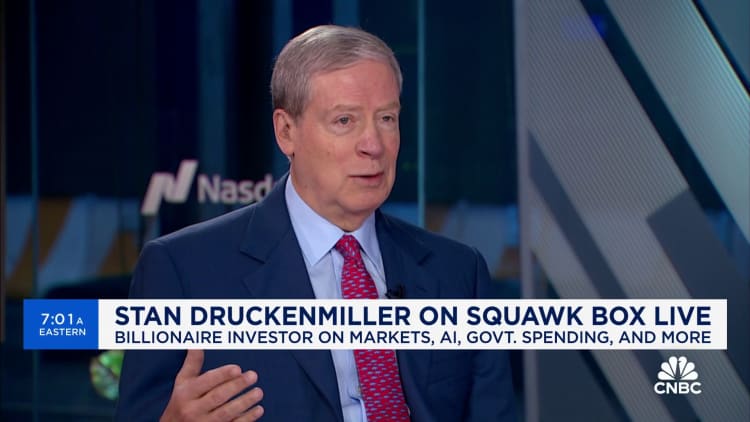

During an appearance on CNBC’s “Squawk Box,” the head of the Duquesne Family Office, which famously shorted the pound in the early 1990s, lashed out at people including Treasury Secretary Janet Yellen and Fiscal and monetary authorities, including Federal Reserve Chairman Jerome Powell.

Additionally, he called “Bidenomics” a failure and said consumers are paying the price for higher inflation.

“People do seem to be more aware of the fiscal situation we face. Everyone seems to understand it except Yellen, who just keeps spending,” Druckenmiller said. “I think it’s politically stupid because it contributes to inflation, and it doesn’t take a genius to figure out that ordinary Americans are being hurt by inflation.”

Druckenmiller’s comments come as the Fed continues to struggle to lower inflation as policymakers have dashed investor hopes of a significant rate cut this year.

He said it would be a mistake to get markets enthusiastic about a rate cut because it would lead to “hot” financial conditions.

“In my view, the Fed is in a perfect position. Inflation is coming down and financial conditions are tightening,” he said. “In a way, I felt like they fumbled it at the five-yard line.”

Fed’s mistake

While Druckenmiller said his company has been a “major beneficiary” of rising asset prices and loose conditions, he still thinks the idea of the Fed stepping up its push for imminent rate cuts in late 2023 is a mistake. The Fed only raised its informal forecast at the time from two rate cuts to three. However, investors interpreted Powell’s comments in December to mean that significant policy easing was coming.

Elected officials generally welcome low interest rates. Druckenmiller said Powell did Biden no favors.

Biden is locked in a tight battle with former President Donald Trump in the November election.

“Biden economics, if I were a professor, I would give him an ‘F,'” Druckenmiller said. “Basically, they misdiagnosed the coronavirus and thought (the economy) was heading into a depression. So did the Fed.”

“The Treasury Department is still acting like we’re in a depression,” he added. “They’ve spent and spent, and my new concern now is that the spending and the resulting interest rates on debt will crowd out some of the innovation that would have happened.”

The outbreak occurred during the Trump administration, which signed a $2.3 trillion coronavirus relief package in 2020. rescue plan.

Druckenmiller also didn’t have much good to say about Trump, who he said may also see inflation during his presidency.

Trump has harshly criticized the Federal Reserve on several occasions during his term in office. Threaten Powell and his colleagues to lower interest rates. Additionally, Trump has advocated imposing high tariffs and said he would do so again if he wins in November.

“With Biden, I’m more worried about stagflation, all the government spending, all the yield curve manipulation techniques Yellen has been using, and the way the Fed seems to be reigniting financial conditions. I think the inflationary outcome is probably going to be there,” Deutsche said. Luckenmiller said. “But I’m also concerned about regulation and other factors that impede productivity.”

“So, I’m basically a no-candidate,” he added. “I’m an old-school Reagan, pro-free market, pro-immigration, anti-tariff Republican.”