Baltimore City Fire Boat No. 2 floats past the Dali container ship after the Francis Scott Key Bridge struck and collapsed into the Patapsco River on Tuesday, March 26, 2024, in Baltimore, Maryland, USA.

Bloomberg | Bloomberg | Getty Images

The collapse of a Baltimore bridge and its knock-on effects could result in the largest marine insurance payout ever, the chairman of insurance giant Lloyd’s of London said on Thursday.

A massive cargo ship hit the Francis Scott Key Bridge on Tuesday, a disaster that analysts predict will cost billions of dollars in insured losses. six people Presumed dead.

Bruce Carnegie-Brown told CNBC: “We are starting to deploy resources in anticipation that this will be a very significant claim for the industry. For the Lloyd’s market, it needs to be It took some time to figure out the complexities of the situation.” “European Scream Box.”

“So it’s premature to call the numbers. At this point I don’t expect this to be outside of our realistic disaster scenario planning. This feels like a very significant loss, probably the largest marine insured loss ever, but it’s not what we planned for external parameters.”

Lloyd’s is one of the world’s largest reinsurers, providing financial protection to insurers unable to cope with the scale of losses incurred.

Carnegie-Brown added that while there would clearly be claims against ships, cargo and bridges, the “secondary impacts” would be “significant”.

“A lot of business is going to be disrupted, supply chains are going to be disrupted with ships that are stuck in the port and, of course, ships that are trying to get into the port but can’t get back in, and those second orders, it’s going to take some time for the impact to show up,” he said.

Baltimore is the 11th largest port in the United States and the busiest port in the country for the import and export of automobiles and light trucks. Supply chain operators are working hard to minimize the impact on trade.

Morningstar DBRS analysts said in a note on Wednesday that insured losses could total between $2 billion and $4 billion, depending on how long the ports are blocked. This figure would exceed the current maximum compensation paid for the capsize of the Costa Concordia cruise ship in 2012.

Various insurance policies covering marine liability and hull, property, cargo and business interruption may be triggered.

“Despite the large insured losses, we expect the insurance industry to still contain losses as they will involve a large number of well-capitalized insurers and reinsurers,” Morningstar said.

Barclays expects potential insurance claims to be between $1 billion and $3 billion.

The Singapore-flagged container ship is chartered by a Danish shipping giant Maersk and was carrying cargo for its clients, but the vessel was operated by charter company Synergy Group.early reports Indicates that the ship has lost power before hitting the bridge.

Singaporean and U.S. authorities will investigate to determine legal liability, part of a complex process that could take months or years.

David Osler, chief shipping and commodities analyst at Lloyd’s List Intelligence, told CNBC earlier this week that Maersk would carry liability insurance as a charterer rather than a ship operator.

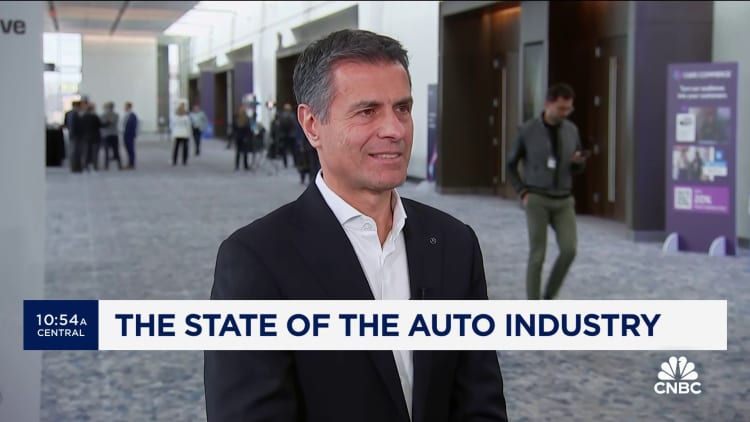

car impact

Barclays analysts said in a report on Wednesday that German automakers BMW, Mercedes-Benz and Volkswagen have been most affected, as European imports have accounted for 40% to 50% of U.S. sales in recent years.

BMW told CNBC that the incident will not affect the supply of materials to its U.S. plants and that the company is in contact with logistics partners about imports. Volkswagen said its port operations, located on the waterfront side of the bridge, would not be affected, but noted it could face trucking delays. Mercedes noted that additional ports of entry, such as Brunswick, Georgia, would help ease import pressures.

“While there will be short-term disruptions to auto imports and exports, I am confident that Customs and Border Protection and regional port and terminal operators will work closely with the auto industry to determine the best transportation alternatives until the Port of Baltimore resumes vessel operations K2 Security Mitch Merriam, Screening’s vice president of border and maritime security, told CNBC via email.

“The Port of Baltimore will be impacted in the short term, but plans are already underway to divert and accommodate additional traffic from other East Coast ports, including Philadelphia, Norfolk, Savannah and Charleston. All of these ports can handle automobiles and light truck”.

The port handles a variety of commodities including sugar and gypsum and is used by retailers including Home Depot, IKEA and Amazon.

— CNBC’s Ganesh Rao and Lori Ann Larocco contributed to this story.