Alphabet Inc. CEO Sundar Pichai speaks at the Stanford Business, Government & Society Forum 2024 on Wednesday, April 3, 2024 in Stanford, California.

Justin Sullivan | Getty Images

As tech giants prepare to report earnings this week, they face a series of dramatic events.

exist Googlethere were protests and reorganizations, while Tesla Just announced massive layoffs, price cuts and Cybertruck recall. Microsoft’s OpenAI relationship faces new scrutiny Yuan Last week’s major rollout of its new artificial intelligence aid didn’t go well.

The troubling news comes amid a generative AI gold rush, as tech giants race to apply the technology to their vast portfolios of products and features to ensure they don’t fall behind in the market they’re expected to emerge. Up to $1 trillion Income over ten years.

Wall Street was nervous about the upcoming earnings, sending the tech-heavy Nasdaq down 5.5% last week, its biggest weekly loss since November 2022. NvidiaTechnology stocks, which have emerged as the darlings of artificial intelligence, led the decline with a 14% plunge.

“I think whether the tech selloff continues will really depend on how big tech stocks perform,” King Lip, chief strategist at BakerAvenue Wealth Management, told CNBC’s “Closing Bell” on Monday. “Valuations are definitely more reasonable now. , because we have made some adjustments.”

Lipp said his company has “cut some of our technology risk” over the past few weeks.

Tech companies have been pouring record amounts of money into emerging generative artificial intelligence startups and investing heavily in Nvidia’s processors to build AI models and run massive workloads. While the market is growing rapidly, investors are increasingly concerned that other issues at hand could cause spending to be curtailed.

On earnings calls this week, companies are likely to continue highlighting their efforts to cut costs and boost profits, an efficiency theme that has persisted across the tech industry since early last year.

Tesla kicked off the tech earnings season after the close on Tuesday, with the electric car maker’s shares falling to their lowest level since January 2023. . Reports from Microsoft and Alphabet on Thursday have Wall Street scrutinizing how companies plan their budgets for artificial intelligence infrastructure.

Here are some of the biggest questions facing Big Tech in this week’s report.

Tesla

On April 15, 2024, a Tesla Cybertruck parked in the open space of a Tesla dealership in Austin, Texas.

Brandon Bell | Getty Images

On Monday, Tesla’s stock price fell for the seventh consecutive day, falling 43% this year. Elon Musk’s electric car company expects sales to fall about 5%, which would be its first year-over-year revenue decline since 2020, when the coronavirus pandemic disrupted operations.

Tesla’s earnings follow a dismal quarterly delivery report and further price cuts for the company’s vehicles and its advanced driver-assistance systems.

Last week, Tesla said it would lay off more than 10% of its workforce, and on the same day, senior executives Drew Baglino and Rohan Patel announced their departures.

“As we prepare the company for the next phase of growth, it is extremely important to consider cost reduction and productivity improvements from all aspects of the company,” Musk wrote in the memo announcing the layoffs.

Two days later, Musk informed employees via email that the company had issued “too low” severance packages to some laid-off workers. On April 12, Tesla voluntarily recalled more than 3,800 Cybertrucks to solve the “stuck pedal” problem described in a popular TikTok video.

“Confidence in Tesla (TSLA) has deteriorated since late 2023,” Bank of America analyst John Murphy wrote in a note on Monday.

Yuan

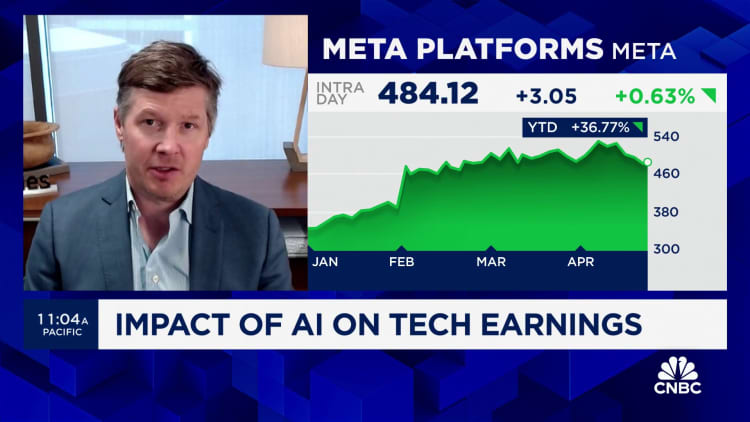

Despite last week’s poor performance, Meta remains a good choice for investors this year.The stock is set to rise 36% in 2024 after nearly tripling last year, when CEO Mark Zuckerberg told Wall Street that 2023 will be the company’s “year of efficiency.”

But Meta still faces many problems. First, its Reality Labs unit, which is responsible for all virtual reality technology for the nascent virtual world, is expected to post a quarterly loss of more than $4 billion for the second consecutive quarter.

In terms of artificial intelligence, Meta last week debuted its assistant, Meta AI, on WhatsApp, Instagram, Facebook and Messenger. It’s the company’s largest-ever artificial intelligence initiative and will compete with OpenAI’s ChatGPT and Google’s Gemini.

But Meta AI quickly sparked controversy.The assistant reportedly joined a private parent group on Facebook and claimed she had Gifted and disabled children, gushed in the comments about his experiences with education programs in the New York area.exist another caseIt reportedly joined the “Buy Nothing” forum and attempted to offer freebies for non-existent items.

Now, as President Joe Biden and Donald Trump prepare for a second showdown, Meta must show it’s ready for a heated election season. Since Trump’s successful presidential campaign in 2016, Facebook has been a problematic place for political speech and misinformation.

Meta expects revenue to rise 26% annually to $36.16 billion, according to LSEG. That would be the fastest pace of expansion at any time since 2021.

letter

Alphabet Inc. CEO Sundar Pichai speaks at the Stanford Business, Government & Society Forum 2024 on Wednesday, April 3, 2024 in Stanford, California.

Loren Elliott | Bloomberg | Getty Images

On Thursday, a busy day for technology financial reports, Alphabet is likely to attract the most attention.

Last week, Chief Financial Officer Ruth Porat announced a reorganization of Google’s finance department, a move that will include layoffs and relocations as the company puts more resources into artificial intelligence.

Google laid off 28 employees that day, according to an internal memo seen by CNBC, following a series of protests over labor conditions and the company’s contracts to provide cloud computing and artificial intelligence services to the Israeli government and military.

Nine Google employees were arrested on trespassing charges Tuesday night after they staged sit-ins at company offices in New York and Sunnyvale, California, including a protest at the office of Google Cloud CEO Thomas Kurian, who was later arrested. Dismissed. The arrests were broadcast live on Twitch and coincided with rallies outside Google’s New York, Sunnyvale and Seattle offices that drew hundreds of participants, according to staff involved.

On Thursday, Alphabet CEO Sundar Pichai announced merge The company’s artificial intelligence team includes Google DeepMind’s responsible artificial intelligence and related research team. “This is a business,” he said in a memo, and employees should not “try to use the company as a personal platform or to fight or debate politics over damaging issues.”

Pichai has been trying to quell employee dissatisfaction over a range of issues since the outbreak began, as the company is forced to contend with slower growth than in years past and an investor base that is increasingly cost-conscious.

Analysts expect first-quarter revenue to grow 13%, which would be the second consecutive quarter of annual growth below 10%. From mid-2022 to mid-2023, advertisers retreated as inflation soared and interest rates rose, with advertisers expanding at single-digit rates for four consecutive periods.

Alphabet shares are up 12% this year, outpacing the S&P 500, which is up 5.1%.

Microsoft

Microsoft CEO Satya Nadella (right) speaks as OpenAI CEO Sam Altman (left) looks on at the OpenAI DevDay event in San Francisco, California, on November 6, 2023. Altman delivered a keynote speech at the first Open AI DevDay conference.

Justin Sullivan | Getty Images

As for Microsoft, the company Seems almost avoided The EU launched an antitrust investigation into its relationship with OpenAI after EU regulators flagged the possibility earlier this year.

Microsoft has invested more than $10 billion in OpenAI, and its ChatGPT chatbot set off a generative artificial intelligence boom in late 2022. The facility becomes a key technology partner of OpenAI.

Microsoft has also invested billions of dollars in artificial intelligence startup Anthropic, and has taken stakes in Mistral, Figure and Humane.

The company’s position in artificial intelligence is the biggest driver of its market value rising to $3 trillion, more than apple As the most valuable American company. However, the stock is up just 6.8% this year, lagging many of its technology peers, and some analysts believe there may be weakness in parts of Microsoft’s customer base, especially small and midsize businesses.

“MSFT has more exposure to small and mid-sized business and consumer risk than any other stock we cover,” analysts at Guggenheim wrote in an April 21 report. There are signs their demand is waning.

Microsoft expects first-quarter sales to grow 15%, but analysts expect sales to slow over the next three periods, according to LSEG.

watch: Tech stocks have more room to fall