Meta Platforms CEO Mark Zuckerberg, July 2021.

Kevin Dickey | Getty Images News | Getty Images

Yuan First-quarter results will be released after the bell on Wednesday.

That’s what analysts expected.

- Earnings per share: $4.32, according to LSEG.

- income: $36.16 billion, according to LSEG.

- Daily active users (DAU): $2.12 billion, according to StreetAccount

- Monthly Active Users (MAU): 3.09 billion, according to StreetAccount

- Average revenue per user (ARPU): $11.75, according to StreetAccount

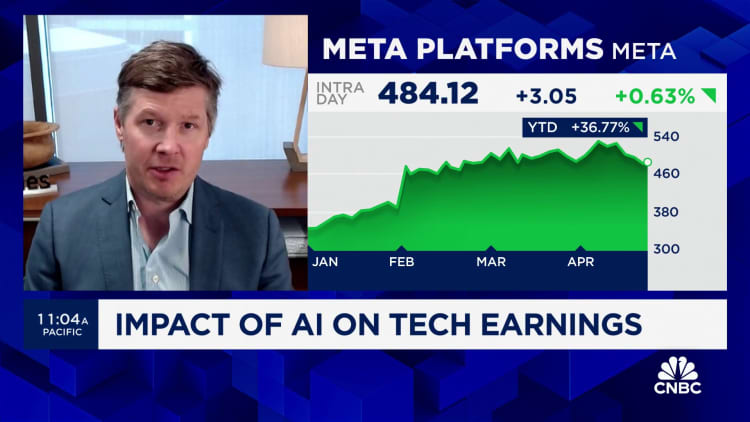

Meta has been favored by Wall Street since early 2023, when CEO Mark Zuckerberg told investors it would be the “year of efficiency.”The stock nearly tripled last year, trailing only Nvidia Among the S&P 500 stocks, it will grow another 40% by 2024.

After a dismal 2022, the Facebook parent company has been taking back digital advertising market share. apple iOS privacy updates and macroeconomic concerns have led many brands to rein in spending.

Zuckerberg is spearheading an initiative to rebuild the advertising business with a focus on artificial intelligence. During the company’s last earnings call in February, finance chief Susan Li said Meta has been investing in artificial intelligence models that can accurately predict user-relevant ads, as well as tools that automate the ad creation process.

Analysts expect Meta’s revenue to grow 26% from $28.65 billion a year earlier. That would mark the fastest growth rate since the third quarter of 2021, when Apple’s privacy changes started showing up on other companies’ balance sheets.

Meta has benefited from a stabilizing economy and a surge in spending by Chinese discount retailers such as Temu and Shein, which have been pouring money into Facebook and the company’s Instagram to attract a wider audience. Baird analysts said in a note on Monday that a slowdown in Chinese advertiser spending could be a reason for concern about first-quarter results.

Still, Baird analysts see continued momentum in Meta and say they have “fairly high” sentiment on the company due to its improving advertiser tools and success in monetizing short-form videos. expect.

Investors will continue to focus on Meta’s costs, which have been at the core of the stock’s rise. Early last year, Zuckerberg said the company would get better at eliminating unnecessary projects and fighting bloat, which would help Meta become a “stronger, more agile organization.”

The company laid off about 21,000 people in the first half of 2023, and Zuckerberg said in February that the scale of hiring was “relatively small compared to where we’ve been historically.”

As of December 31, Meta had global workforce The company has 67,317 employees, down from a peak of more than 87,000 employees in 2022, according to SEC filings.

“Excellence is indisputable,” Jefferies analysts wrote in a note last week. Analysts expect Meta to report better-than-expected first-quarter results and provide better-than-expected guidance for the second quarter. According to LSEG, so far, analysts on average expect second-quarter revenue to grow 20% to $38.29 billion.

“We continue to be encouraged by META’s ability to sustain double-digit revenue growth given higher engagement from its AI investments and improved advertiser ROI and efficiency,” Jefferies analysts wrote.

Meta’s Reality Labs division, responsible for the hardware and software the company uses to develop nascent virtual worlds, continues to bleed cash. Analysts expect the unit to post an operating loss of $4.31 billion this quarter, adding that it has lost $42 billion since the end of 2020. when.

Executives will discuss the company’s results on a conference call with analysts at 5 p.m. ET.