U.S. Securities and Exchange Commission Chairman Gary Gensler declined to comment on Tuesday on speculation that Trump Media was a funder of Donald Trump’s presidential campaign.

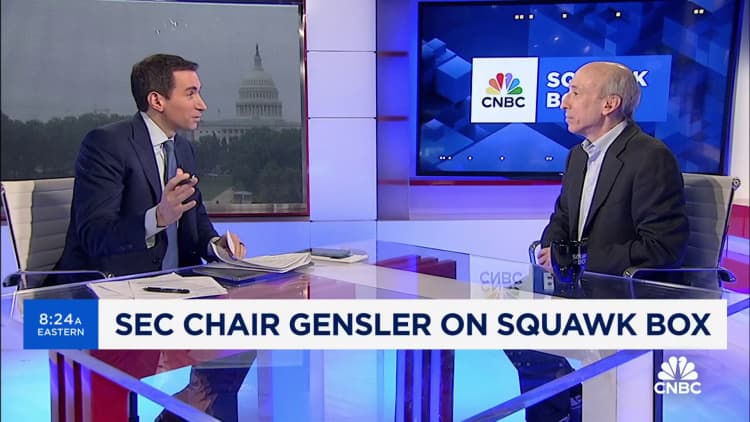

“I’m not going to talk about any one company,” Gensler said in an interview on CNBC’s “Squawk Box” about whether Trump Media Just a vehicle to fund the former president’s re-election campaign.

“It’s important that their disclosures are accurate and that people are not front-running the market or trading on inside information,” Gensler said.

since DJT Since its listing on Nasdaq on March 26, the stock price has fluctuated significantly, with a high price of nearly $80 per share and a low of about $12 per share. The stock opened Tuesday at around $49.

As the majority shareholder, Trump will receive the biggest financial boost from DJT’s rise.

On Friday, Trump’s holdings increased by 36 million shares to the existing 78.8 million shares due to a provision in the company’s contract that unlocked bonus shares when the stock hit certain checkpoints. As a result of the gains, Trump’s holdings had a book value of more than $5 billion at Tuesday’s opening bell.

Trump still banned from cashing out due to standards lock-in terms The contract required him to wait six months before selling or trading any shares.

But after that deadline, it could be a timely windfall for the former president, who has faced a series of financial woes stemming from several lawsuits and presidential campaign expenses.

Trump’s campaign is showing early signs of budget crunch, raising questions about whether the Republican nominee will turn his DJT stock into campaign fuel.

The DJT stake has another benefit for Trump: There are no limits on the size of investments in Trump media, as there are caps on donations to Trump’s presidential campaign, which relies heavily on high-dollar donors.

Trump has not said whether he will use his shares of DJT for political financing.

Given the stock’s unusual volatility, some believe it’s a sign that investors are trading based on factors other than market indicators.

Gensler also dodged questions about whether DJT’s erratic stock behavior was a potential sign of market manipulation.

Trump Media CEO Devin Nunes claimed the stock’s rapid decline was the product of possible “naked” short selling, which is a trade in which sellers bet that a stock’s price will fall.

“Everyone can form their own opinion. That’s one of the beauties of our capital markets,” Gensler said. “This is something thousands of people can do their own research on.”