On April 15, 2024, London, England, rows of new cars were parked in the waiting area near the customer collection point.

Lionel | Getty Images

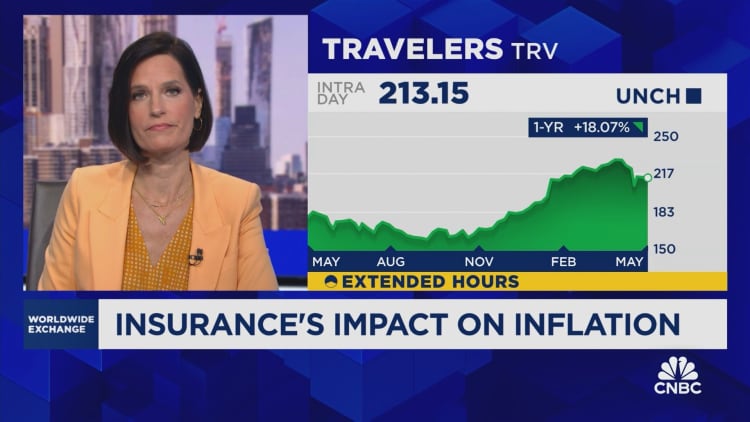

Bank of America said soaring auto insurance costs were the main driver behind inflation over the past year, but the situation may be easing.

Economists at the bank believe that easing several drivers behind rising costs in the coming months could take some of the heat off some of the categories that push the Fed to continue fighting inflation.

“The sharp increase in motor vehicle insurance premiums is a response to the industry’s underwriting losses. Insurers have suffered losses,” Bank of America economist Stephen Juneau said in a report. However, he added, “There are signs that many insurance companies are returning to profitability.”

Juneau said the hit to insurance companies has been passed on to consumers, mainly from three sources: higher car prices, higher repair costs and “an increase in accidents as driving trends return to normal.”

There is some good news on this front.

Sales prices for new and used cars have been on a downward trend in recent months, down 0.4% and 6.9% respectively over the past 12 months. Bureau of Labor Statistics data to April. In addition, the cost of repair and maintenance services in April was the same as the same period last year, but still increased by 7.6% compared with the same period last year.

However, motor vehicle insurance costs continue to soar.

The category rose 1.8% month-on-month in April and 22.6% year-over-year, the largest annual gain since 1979, according to Bank of America data.

In the CPI calculation, auto insurance accounts for close to 3% and is an important component.

Juneau said recent trends may not “mean your premiums will go down, but we think growth should slow down.”

This is the general picture of inflation: prices are not falling, but growth is well below where it was in mid-2022, when inflation reached its highest level in more than 40 years. The overall CPI inflation rate in April was 3.4%.

There is another piece of good news regarding Fed policy.

The central bank’s main inflation barometer is the Commerce Department’s measure of personal consumption spending, not the Bureau of Labor Statistics’ Consumer Price Index. Auto insurance has a smaller weight in the personal consumption expenditures measure, meaning it contributes less to inflation.

If BofA’s forecast of deflation in the insurance industry is accurate, it could at least give the Federal Reserve more confidence to begin cutting interest rates later this year. Current market pricing shows that the first price cut is expected in September, with another possible price cut before the end of the year.

“We believe further improvement in this aggregate is key for the Fed to become more confident in the deflationary process and begin a rate-cutting cycle,” Junod said. “Until then, we expect the Fed to keep rates on hold.”