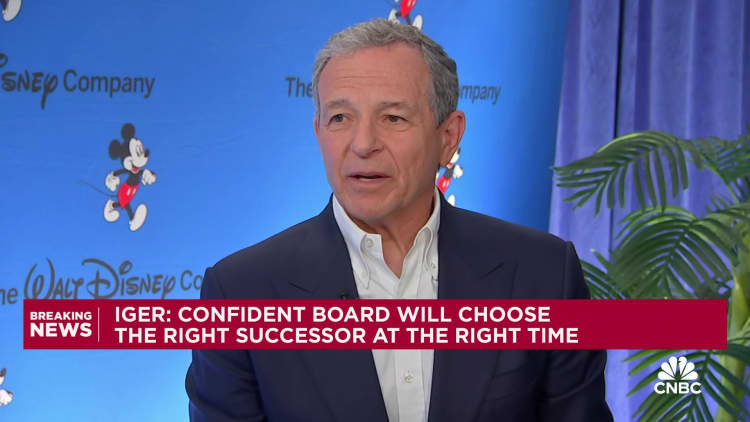

Nelson Peltz’s proxy fight a ‘distraction’ disney CEO Bob Iger told CNBC’s “Squawk on the Street” Thursday that the company can now focus on turning a profit and planning its succession, a day after the activist investor A miserable failure.

“One of the things that feels great about me right now is that, winning aside, I can spend all my time working with the management team and the board to execute on these priorities,” he said.

While Disney has launched a series of moves in recent months to boost its stock price as the boardroom battle continues, Iger noted that Peltz’s second proxy attempt has had little impact on the company’s succession strategy, business investments or content Change of plans.

Iger told CNBC that choosing his successor “is the board’s No. 1 priority.” He said Disney’s succession committee, which was formed when he returned to his post at the end of 2022, held multiple meetings in 2023 and planned more meetings in 2024. Iger noted that this activism did not change Disney’s succession process. Iger’s contract runs until 2026.

Iger discussed the challenges faced by Bob Chapek when he took over the company in 2020, including the shutdown of film and television production, theme park closures and the cessation of live sports events. Iger returns to the position after Chapek held the position for more than two years.

“Obviously, we have all learned from the past and we are well positioned for the success of this process,” Egger said.

Peltz told CNBC on Thursday that he had no personal grudge against Iger but wanted to make sure the company had an appropriate leadership plan in place.

“The only issue I have with Bob is succession planning, which again is a board decision,” he said.

Iger also disputed the idea that Peltz’s activism contributed to the recent rise in the company’s stock price — a claim from investors themselves.

“The market is reacting to the performance of this company,” Egger said. “It didn’t really respond to the activist.”

Disney stock has risen 32% so far this year. The company made a slew of big announcements on the earnings call, including acquiring exclusive streaming rights to Taylor Swift’s Eras Tour concert film, a $1.5 billion strategic investment in Epic Games and the launch of a flagship ESPN, followed by a rise in the company’s stock price in February. Streaming services.

Disney has been locked in a battle for months with Peltz’s Trian Fund Management, which is seeking two board seats at the company. Peltz has publicly lambasted Disney’s continued underperformance of its stock price, its failed succession process and what he said were billions of dollars in misdirected investments.

Peltz told CNBC that if Iger continues with his plans to improve the company’s performance, he won’t try to start another battle with Disney.

“I hope Bob keeps his word,” Peltz said Thursday. “I hope they do everything they promised us. I’ll watch and wait. If they do, they won’t hear from me again.”

Shareholders sided with Disney at Wednesday’s investor meeting. People familiar with the matter said Peltz lost the race for the board seat by a 2-1 margin to Maria Elena Lagomasino, a former Disney CFO who Trian also nominated. Jay Rasulo lost to Lagomasino by a 5-1 margin. Things are said. The person added that retail voters overwhelmingly supported Disney, helping Iger receive 94% of the overall vote.

A second activist, Blackwells, also failed to win a board seat in his ambitious bid.

Turnout for director votes was in the 60s on a percentage basis, another person familiar with the matter said. In 2023, approximately 63% of Disney shareholders voted.

Since returning to the helm of Disney at the end of 2022, Iger has made many efforts to turn around Disney’s decline. He scrapped a new corporate structure put in place by the short-lived Chapek and slashed the number of film and television projects the company was producing. Iger also announced last year that he plans to invest $60 billion in Disney’s theme parks, cruises and experience businesses over the next 10 years.

Next up are new bundled sports services with Warner Bros. Discovery Channel and Fox, as well as a flagship standalone ESPN service that will eventually be available directly through Disney+.

“Basically what we want to do is serve sports fans in multiple ways,” Iger said, adding that he doesn’t foresee significant cannibalization between the two products.

Iger said the flagship ESPN service will have much more content than the joint venture’s ESPN portion. He declined to reveal more information about the joint venture, including a potential name or price point for the service.